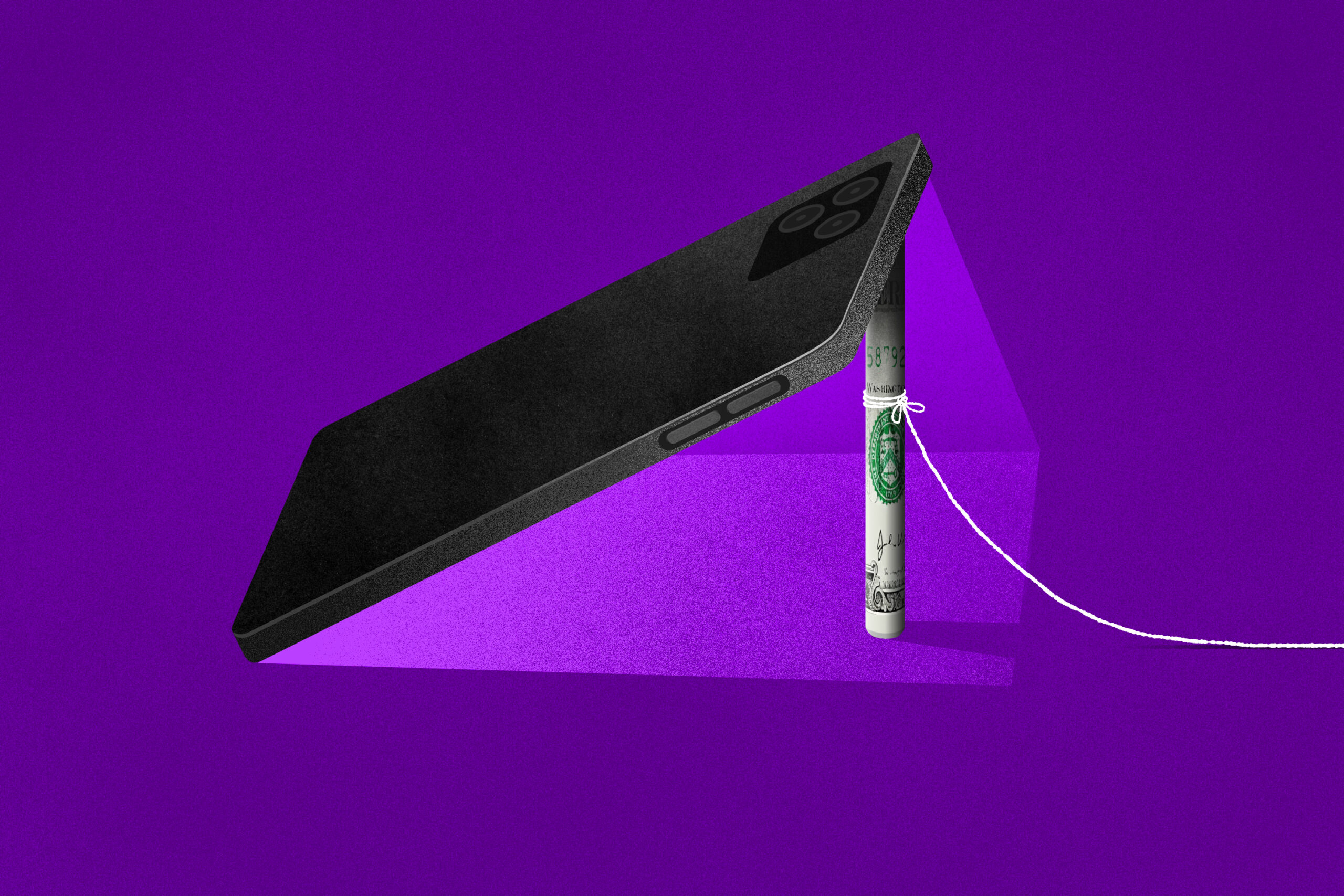

The Justice Department and Federal Trade Commission have announced a civil enforcement action against financial technology company Dave Inc. and its CEO Jason Wilk for allegedly violating the FTC Act and the Restore Online Shoppers’ Confidence Act. The lawsuit claims Dave misled consumers about its cash advance services by deceptively advertising “up to $500” in instant advances while rarely providing such amounts, charging hidden “express fees” and recurring monthly fees without a clear way to cancel, and implementing a deceptive tipping interface. The complaint also alleges that Dave falsely claimed customer tips would purchase meals for needy children, while the company kept most tips for profit and made only nominal charitable donations.

“The Justice Department is committed to stopping companies and their executives from preying on financially vulnerable consumers with deceptive advertisements, hidden fees and subscriptions that are difficult to cancel,” said Principal Deputy Assistant Attorney General Brian M. Boynton.

The move comes 18 months after a Fuller Project investigation into the Earned Wage Access industry, a $9.5 billion, fast-growing sector that has been almost entirely unregulated. The story showed how paycheck apps, which include such brands as Dave, EarnIn, Daily Pay, and Brigit, offer high cost cash advances, which like payday loans, are disproportionately used by women of color. Our reporters found that the young women who use the apps often end up trapped in a cycle of debt — with promises of quick cash for groceries, rent and children’s birthday parties masking effective annual interest rates of over 300%.

The complaint, filed in the U.S. District Court for the Central District of California, seeks consumer redress, monetary civil penalties, and a permanent injunction against future violations. It amends and replaces an earlier FTC complaint that only named Dave as a defendant and did not seek civil penalties.

This case highlights increasing regulatory scrutiny of fintech companies, particularly those offering services to financially vulnerable consumers. The inclusion of the CEO as a defendant also signals a willingness to hold individual executives accountable for corporate practices.

Since then two states, Maryland and Connecticut, have stepped in to regulate these apps, requiring most smartphone-based cash advances to follow their states’ interest rate limits — 36% for Connecticut, 33% for Maryland for small loans — with tips and instant access fees included.

Read our original investigation, which was published in partnership with the Los Angeles Times.